As we covered in depth across our neobank series, neobanks face a unique challenge: how to scale their customer experience (CX) without losing the simplicity that made them attractive in the first place.

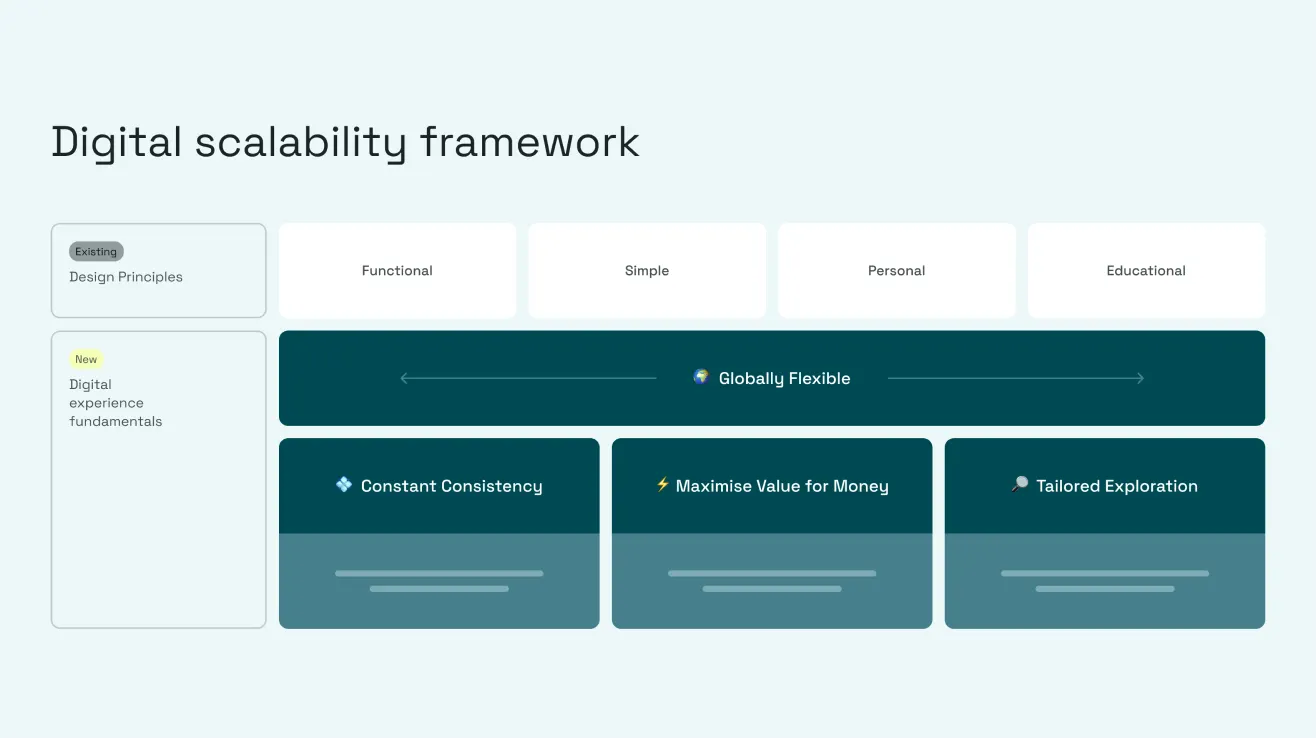

At Elsewhen, we recently partnered with a leading UK neobank to tackle this exact issue. Our solution? A framework built on four fundamental principles that balance growth with user-centric design.

Globally Flexible

Great CX is about solving real problems. As neobanks expand their offerings globally, they must ensure each new feature serves a clear purpose while adapting to global needs. This means taking a hard look at what your users truly need in different regions and contexts, not just what's trendy or easy to implement uniformly.

You'll want to prioritise features that address genuine pain points in your users' financial lives regardless of their location or background. Perhaps it's simplifying cross-border payments or offering smarter budgeting tools. Whatever it is, it should make a tangible difference to your customers' banking experience, adapting to their specific market and needs.

But being globally flexible isn't just about individual features. It's about how these features work together to create a cohesive ecosystem that can flex to different markets and user types. New products and services should integrate seamlessly with your existing offerings, while allowing for necessary local variations.

And the work doesn't stop at launch. To truly meet diverse needs, you must constantly evaluate your functionality against user feedback and behaviour across different markets and segments. Are people in various regions using the features as intended? Are you accommodating different financial customs and regulations effectively? This ongoing assessment ensures you're not just adding features for the sake of it, but truly adding value to your users' lives, wherever they are.

By focusing on adaptability in this way, you're building a banking experience that genuinely improves your customers' financial well-being across diverse markets and segments. You're not just adding features – you're creating a flexible, globally relevant platform. And that's the kind of approach that drives long-term growth and loyalty in an increasingly interconnected world of neobanking.

Constant Consistency

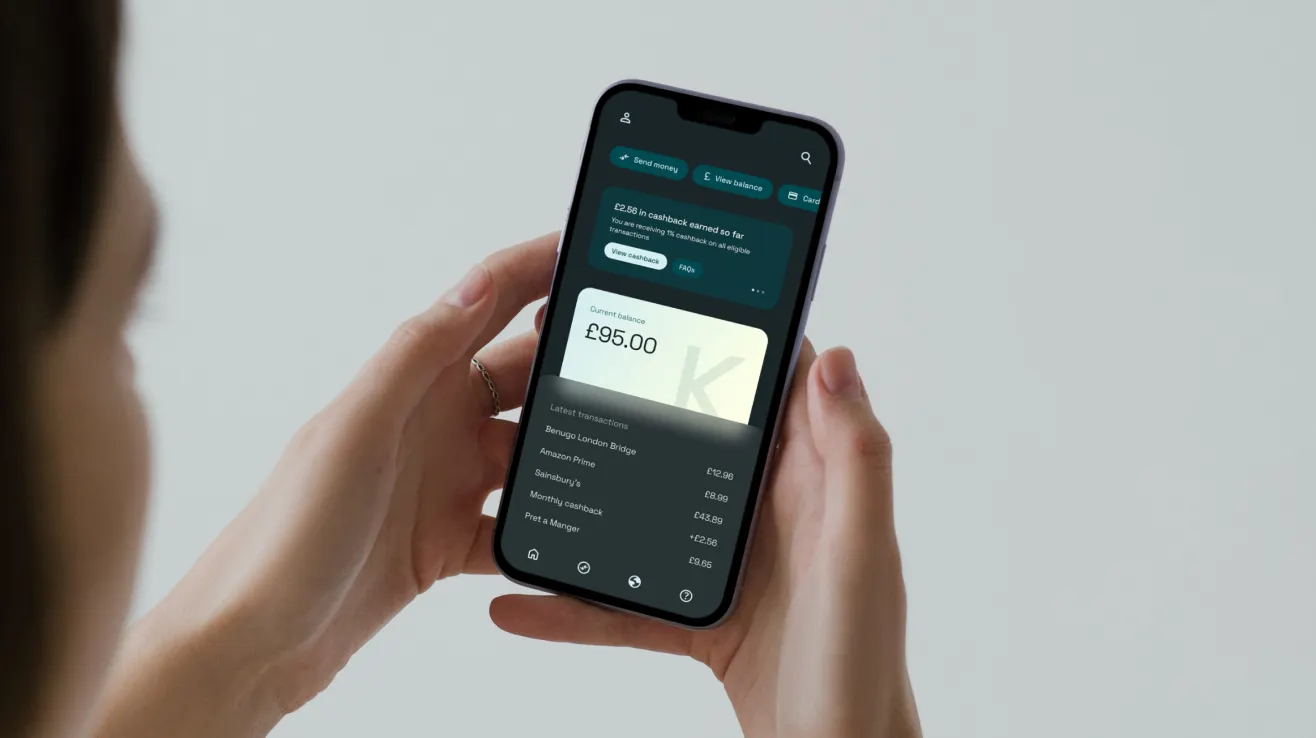

Simplicity is the hallmark of successful neobanks. It's what set them apart from traditional banks in the first place. But as your product suite grows, maintaining a simple and consistent interface becomes a real challenge. How do you add complexity without compromising on ease of use?

The answer lies in smart and consistent design choices. As you add new services, focus on streamlining user journeys. This might mean rethinking your app's navigation or finding clever ways to integrate new features without cluttering the interface. The goal is to guide users smoothly from A to B, even if the path behind the scenes is more complex.

Language plays a crucial role too. Banking is full of jargon, but your app shouldn't be. Use clear, everyday language throughout. Explain complex financial concepts in simple terms. Your users shouldn't need a finance degree to understand their own money.

Familiar design patterns are your friends here. Users come to your app with expectations based on their experiences elsewhere. By employing intuitive, recognisable design elements, you make new features feel familiar from the start. This reduces the learning curve and helps users adapt quickly to new offerings.

Remember, a simple experience isn't about having fewer features – it's about making complex tasks feel effortless. By focusing on these principles, you can grow your product offering without growing user confusion. In the world of neobanking, that's a competitive edge worth having.

By employing consistent design elements, new features feel familiar

Tailored Exploration

As your digital banking platform expands, guiding users to relevant products and services becomes crucial. Tailored exploration is about creating personalised pathways for users to access what they need, when they need it.

This starts with exposing interrelated information intelligently. By analysing user behaviour and preferences, you can showcase adjacent and complementary products, features, tools, and content that connect to the customer's primary task. For instance, if a user is checking their savings account balance, you might highlight relevant investment options or tips for reaching savings goals faster.

Anticipating the next step is key to tailored exploration. Predict the customer's journey, both within the app and in their financial life, to create clear and efficient paths towards the next actionable step. If someone's exploring mortgage options, proactively offer information about the house-buying process or connect them with relevant financial advisors.

Allow for multiple discovery behaviours to cater to different user preferences. Create various methods for customers to find products, features, tools, and content. This includes both direct discovery, like an intuitive search function, and indirect discovery through contextual suggestions and smart navigation design.

By tailoring exploration in this way, you're creating an experience that feels personalised and intuitive. Users can easily find what they need and discover relevant services they might not have known about. In a competitive digital banking landscape, this approach to discoverability can be what keeps users engaged and loyal, even as your offerings expand and evolve.

Maximise Value for Money

In neobanking, creating meaningful value exchange moments is crucial. It's about identifying and leveraging key interactions to build engagement and deliver tangible value to users.

Make it worth their time. High-effort tasks deserve high-value rewards. When asking users to provide detailed information or complete complex processes, ensure they see a clear, significant benefit upfront. For instance, if you're requesting comprehensive financial data, show how this will unlock personalised insights or exclusive offers that genuinely improve their financial well-being.

Boost customer intent by increasing the prominence of your most valuable or relevant services. Highlight the best options for each user, making it easy for them to take action. If you're introducing a new savings feature, showcase it prominently to users who could benefit most, explaining clearly how it outperforms their current approach.

Showing clear benefits is key. Use the data you have on each customer to demonstrate why your products and services will make their lives better. Don't just tell a user about a new investment product — show them a projection of how it could grow their wealth over time, based on their current financial situation.

By focusing on these key moments, you're not just offering banking services — you're creating experiences that actively engage users and demonstrate your platform's worth. Each interaction becomes an opportunity to prove your value, encouraging deeper engagement and fostering long-term loyalty.

For maximum value, creating meaningful CX moments is crucial

Bringing It All Together

These new fundamentals don’t replace what’s already working — they build on and augment the core principles of functional, simple, personal, and educational CX. The real power comes when human expertise aligns with cutting-edge technology, creating a CX that’s scalable and future-ready. It’s about evolution, not disruption — augment, don’t destroy.

Ready to take your neobank's CX to the next level? Let's talk about how these fundamentals can work for you. In the meantime, check out our case study to hear more about how we’ve helped shape a leading neobank’s CX strategy.