The last few years have been a difficult period for neo and challenger banks. High interest rates and economic headwinds have created a difficult fundraising environment, limiting the ability, for particularly immature players, to lean on rounds of fundraising to sustain growth – the end of the “grow at all cost” mindset. With only 5% of neobanks profitable in 2023, the focus has firmly shifted towards profitability.

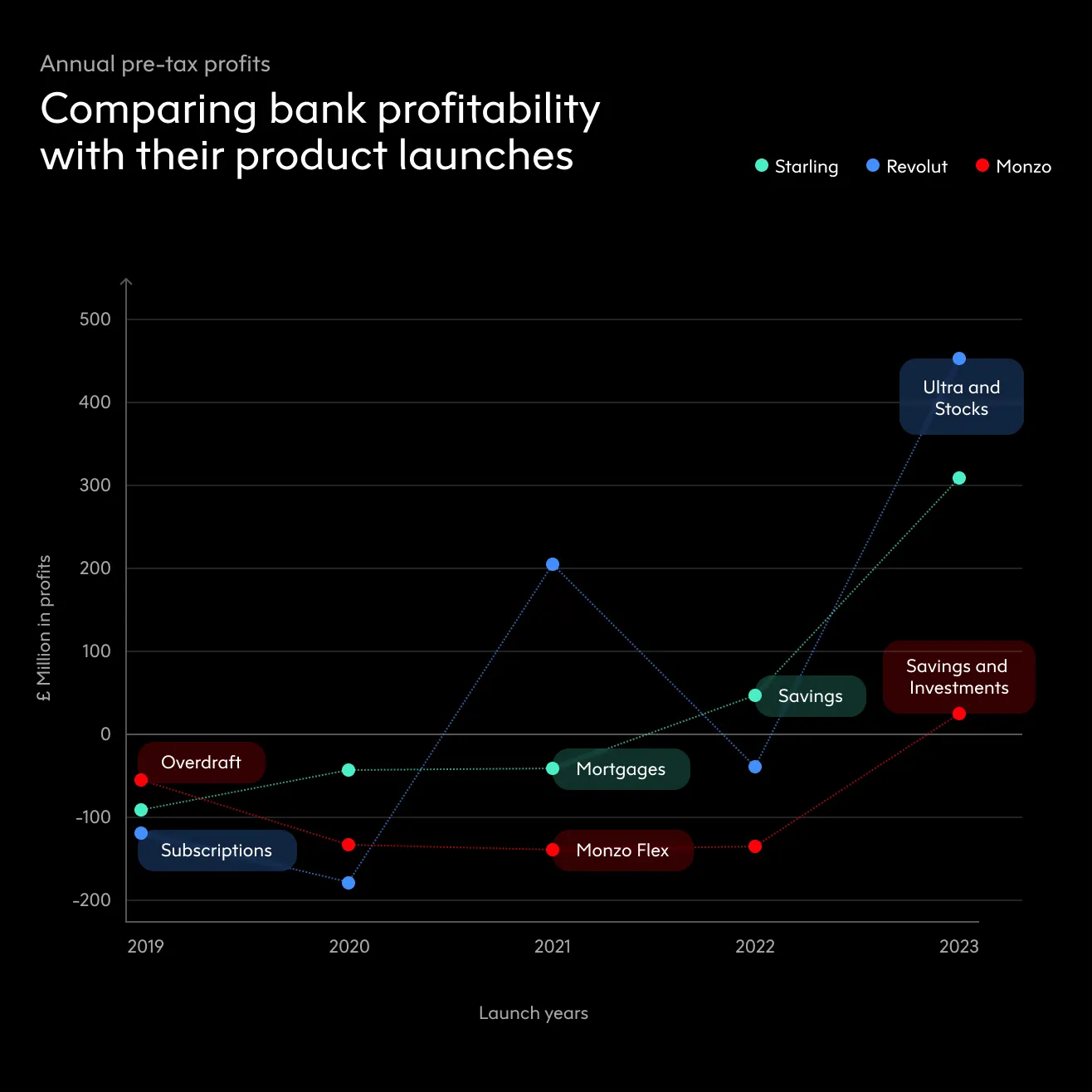

In fact, we have already seen neobanks, including incumbent speedboats, evolving towards new earning models that drive more sustainable growth and profitability. As seen in the graph below, more established players, such as Starling Bank, Monzo and Revolut, have leant into the opportunities represented by lending products and subscription models, leveraging their sizable customer base and boosted rates to finally start making money.

Comparing profitability with product launches

Across the industry, we see this trend deepening further, with neobanks shifting towards “full-service” digital banking models. To acquire a larger share of customer wallets, neobanks should now enrich their proposition, income sources and product suite - with credit cards, personal loans and insurance being just the beginning.

For more mature players, this means diversifying their product offerings even further (see above). For example, Revolut recently expanded its subscription offering, launching a $45 a month Ultra account, as well as targeting an extra £300 million in revenue from their new retail media offering. Elsewhere, Monzo successfully launched their investment product in 2023, and, more recently, re-branded and broadened their own subscription tiers.

But, what does this mean for digital teams?

The multi-product CX challenge

Neobanks and speedboats often start with a simple proposition. Operating in one market, serving one or two customer segments, and offering one or two basic products, such as current accounts or a savings product.

Digital teams begin to tackle the multi-product CX challenge

This simple proposition is reflected in their app and makes for an enjoyable, highly rated customer experience. However, when neobanks look to add their next product(s) - perhaps a credit card, loan, or trading capabilities, this will almost certainly affect the experience.

From the Digital Experience perspective, scaling products and services puts a significant strain on Neobank’s apps. In particular, digital teams face a difficult tradeoff between creating or changing app real estate to promote new products and drive revenue, and maintaining their digital-first, user-centric competitive advantage over incumbents.

In this blog, we will look at NuBank and analyse how they successfully managed the shift from a single product environment to a multi product one, and draw some conclusions on how other banks might tackle this problem too.

NuBank

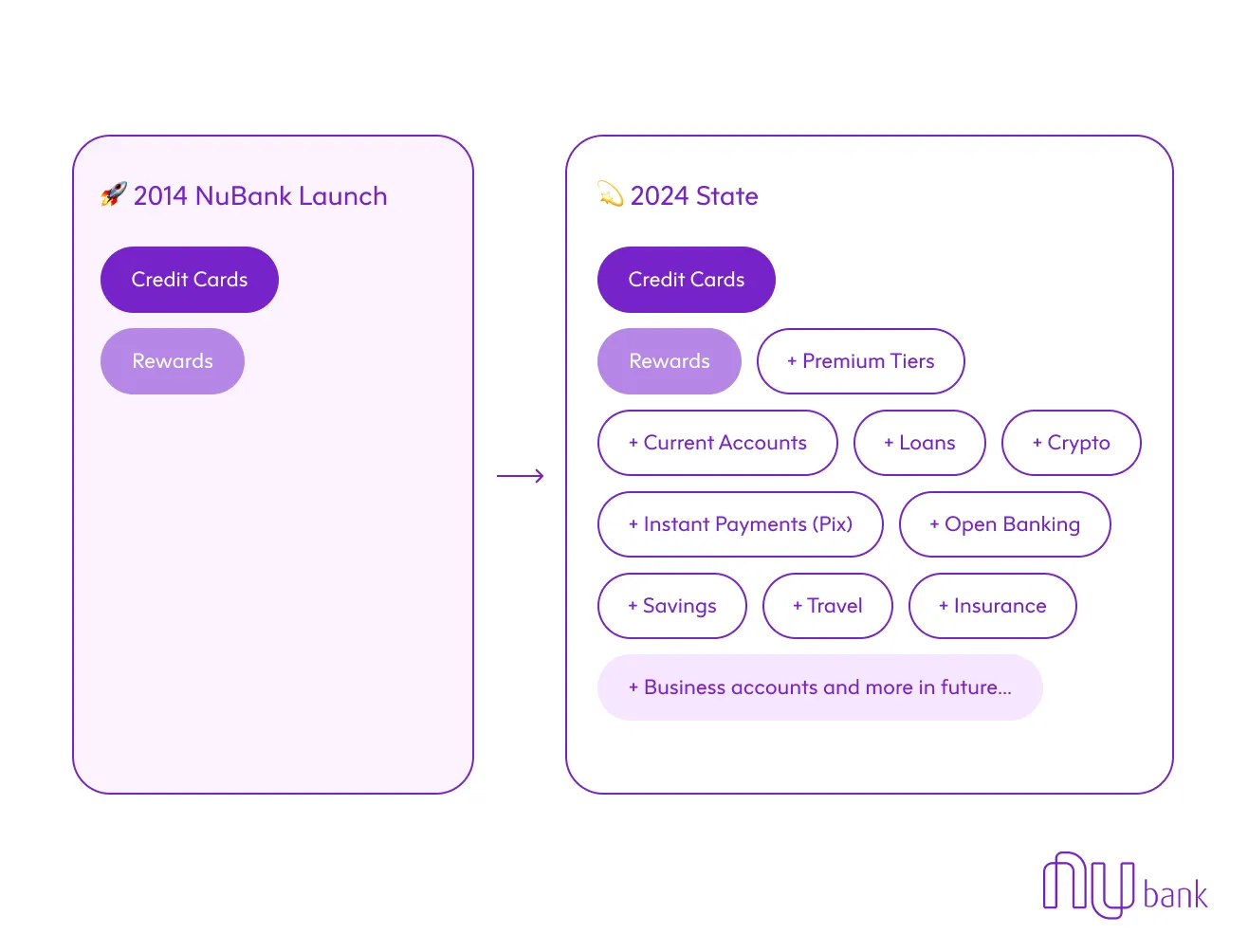

Nubank is a Brazilian bank launched in 2014 which has recently grown to more than 100 million customers and, after a 2021 IPO, is currently valued at $51 billion; the most valuable neobank in the world. Nubank successfully launched in Brazil with a fee-free credit card proposition that targeted unbanked and underbanked segments of the population with low barriers to entry.

NuBank have diversified their offering since launching in 2014

As you can see in the image above, over time, Nubank looked to diversify its offering and continue its success, by introducing current accounts, insurance, investments, crypto and personal loans amongst other products. Admittedly, local nuances, such as demographic and regulation, have been a large driving force for their growth and success. However, we can learn a lot from their approach to introducing new products that has produced results not seen elsewhere in the market; reaching sustainable profitability after 7 years whilst consistently driving customer growth and engagement.

Nubanks Earnings Formula

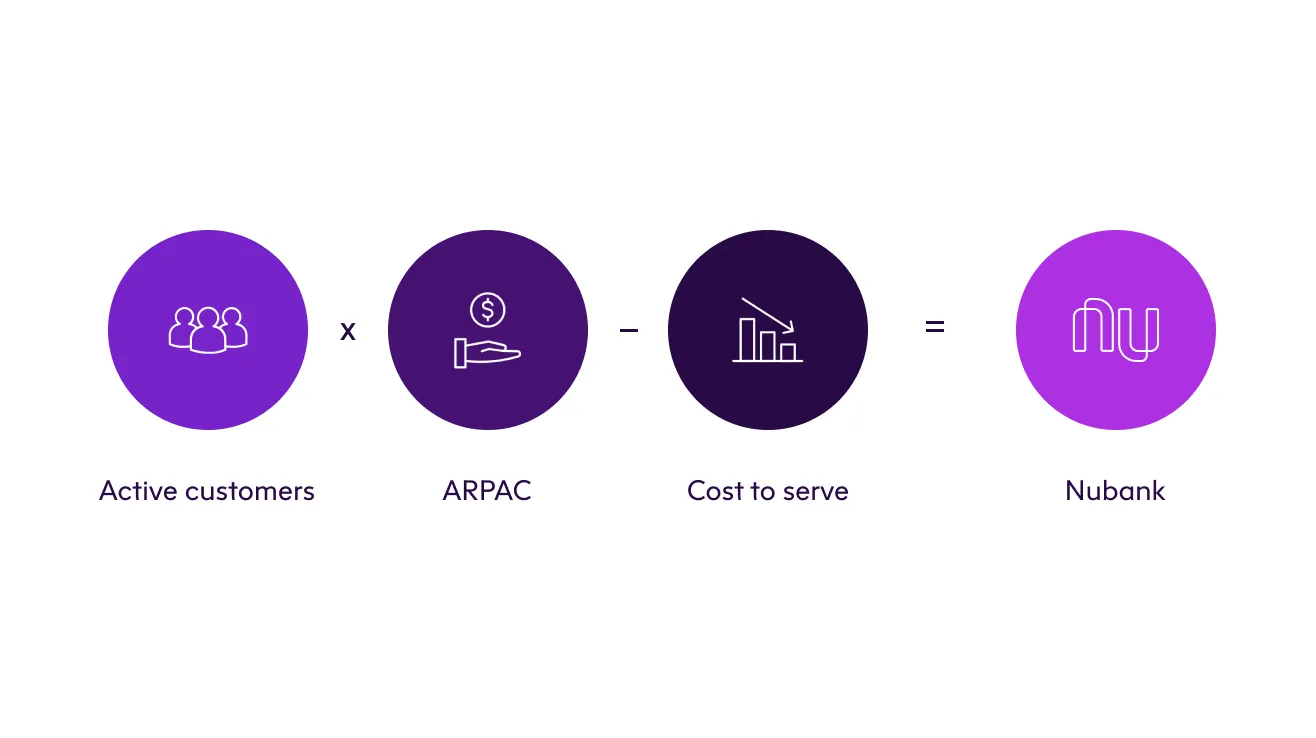

Nubanks earnings formula illustrated

True to its mission to fight complexity to empower people in their daily lives by reinventing financial services, Nubank developed a model that favours and integrates customer-centricity into its earning model. Aiming to offer and promote products, features and experiences that serve both customer Jobs-To-Be-Done and business objectives, Nubank’s earnings formula prioritised Active Customers (see below) and growing Active Revenue per Active Customer (ARPAC), whilst minimising Cost to Serve.

By linking its earning model directly to these three pillars, Nubank leans into activity and retention for its customer-centric approach. ‘Active Customers’, which Nubank defines as those customers who generated revenue in the last 30 days, is used as a proxy of activity. And, ARPAC (average revenue per active customer), which is 3x higher amongst more mature cohorts of customers, is used as a measure of retention.

Importantly, Nubank has consistently moved the needle on its earning formula. In 2023, 83% of Nubank customers were active, up from 65% in 2020. In terms of ARPAC, Nubank exceeded the $5 milestone by the end of 2021, in the first quarter of 2024 they have now reached $11.4. And, on cost to serve, despite growing to more than 100 million customers, they have kept the monthly cost to serve at $0.9 between 2021 and 2023. The end result? In 2023, Nubank hit £1 billion in net profit.

So how did they get here:

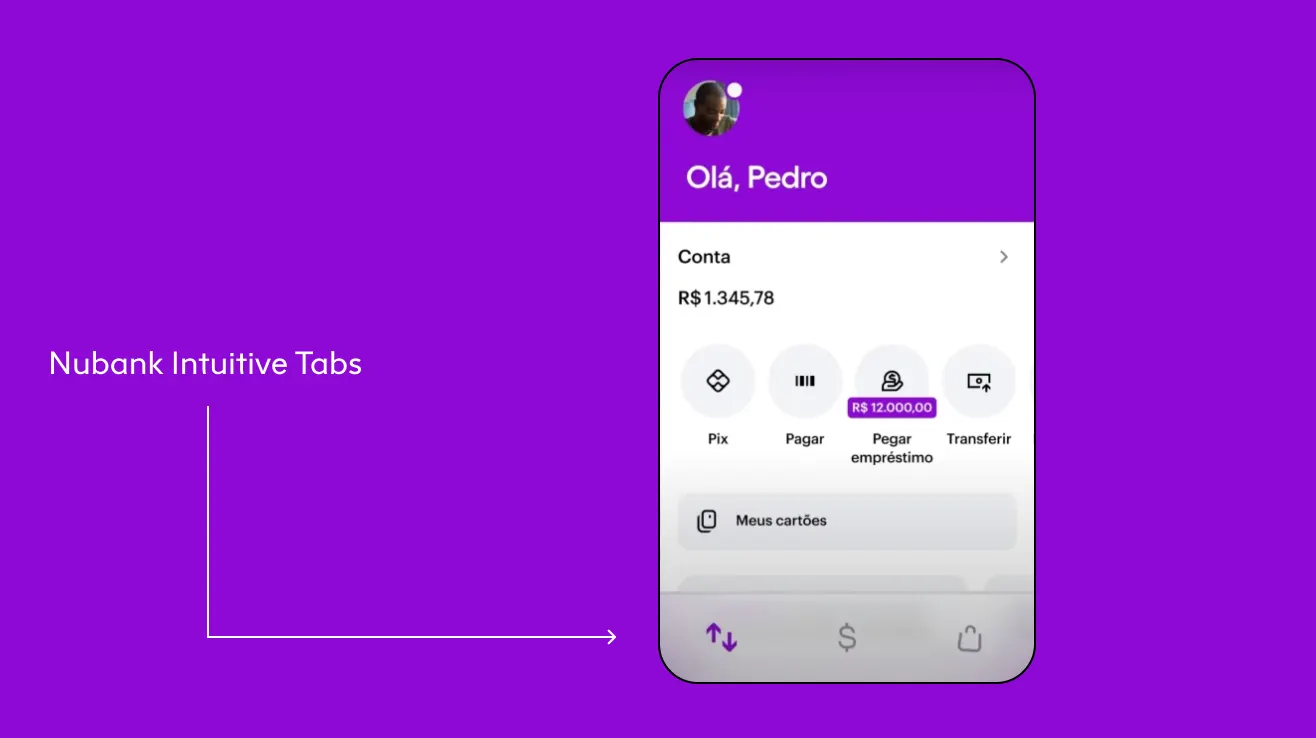

1. Nubank introduced intuitive tabs to simplify the multi-product experience

As Nubank launched its new products, their digital team aimed to maintain their helpful, contextual and simple-at-a-glance experience. Meanwhile, from a business perspective, the existing IA and UI limited the ability to launch new products. Nubank required an approach that simplified the customer experience whilst creating space to add more products.

Nubank have introduced intuitive tabs to their user-experience

In response, Nubank redesigned their IA, introducing 3 tabs focused on three different customer mental models (unlike many banking apps): day-to-day transactions, financial planning and discovering new things. This new approach not only simplified navigation, e.g. providing a designated area to manage investments, but also created a contextual space to integrate and scale new products e.g. brokerage would be added to planning.

Significantly, this approach enabled Nubank to balance their customer experience and business objectives. In 2023, Nubank achieved the highest NPS score amongst Brazilian financial services platforms whilst launching more than 45 products and features and growing customer engagement by 23%.

2. Nubank used “intelligent suggestions” to streamline product discovery

As even more products were added to the app, Nubank wanted to ensure that the product discovery journey remained simple and relevant. On one hand, the journey needed to be helpful; empowering customers to make informed financial decisions. On the other hand, from a business perspective, limited and fixed app space limited the ability to promote new products.

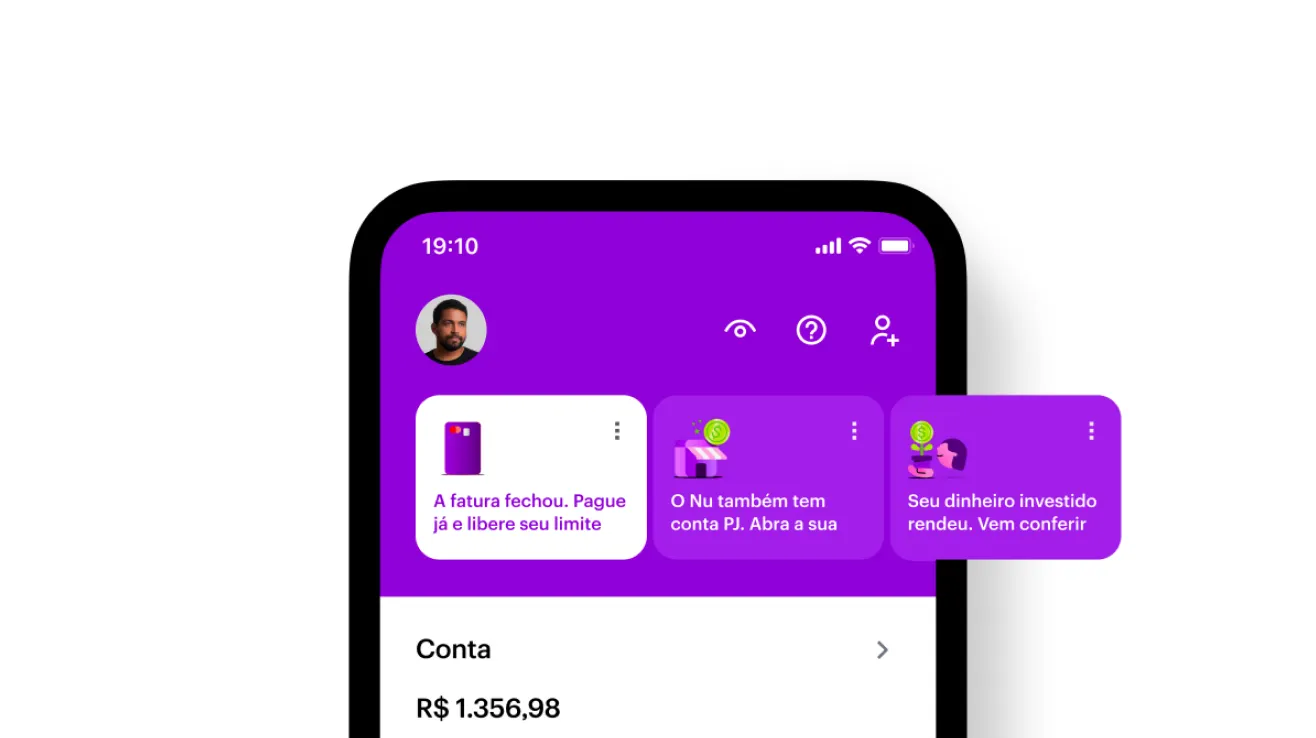

Nubank app now features intelligent suggestions

Nubank implemented tailored messages and recommendations, found at the top of the home page, based on user behaviour and preferences. This sought to empower customers to stay organised, never miss important actions, and make smarter, more informed financial decisions. From a business perspective, tailored messages also introduced a more dynamic and contextual approach to promote/cross-sell new products and services and capitalise from customer intent.

This was not all plain sailing. By introducing more content at the top of the home page, content that was previously visible to the customer had been shifted downwards. Nubank needed to understand the negative impact on content further down the page. Similarly, the success of the feature is determined by multiple product areas. Nubank needed to align different teams, metrics and datasets to measure and understand impact. To solve this, Nubank created a measure to facilitate decision making – incorporating metrics from across different business units to prioritise one use case over another.

Plus, the feature introduced the ability and temptation to heavily promote new products to customers and drive business value. However, the hierarchy of suggestion prioritised resolving existing and potential customer problems over promotional messages. Here, they prioritised customer centricity over business value.

What can we learn from this?

Through the example of Nubank, we have seen that an effective strategy for introducing and scaling products and services must strike a difficult balancing act between customer centricity and business value. Whilst a customer-centric model places customers’ complex financial journeys at the centre of decision making, flexing to the commercial needs of the organisation is fundamental to survival. And with business objectives in the driving seat, neobanks will sacrifice their CX, losing the competitive advantage that drew customers away from traditional banks in the first place.

Once organisations have recognised this balancing act, it is then the role of executives and senior leaders, from across product, design or engineering, to start exploring what this might look like in practice. This might include:

New customer journeys that manage the complexity of new products e.g. onboarding journeys with additional credit or eligibility checks.

Redesigning IA and UI that enables customers to have multiple products e.g. a home screen that can display different types of balances for multiple products.

Creating app real estate to allow customers to manage their new products e.g. paying off a card, managing their credit limits, etc.

Building data capabilities to support new mechanisms for customers to discover products, e.g. personalised recommendations

Constructing frameworks, supported by KPIs and metric, to aid decision making e.g. combining CX and business metrics to support the launch of new products and services in the future.

While not straightforward, by applying customer centric thinking with commercial acumen, banks and other financial institutions can create great digital experiences while taking their products to the next level and into new markets. At Elsewhen, through a wealth of experience helping financial services deliver digital products, strategy and transformation, we are uniquely positioned to help organisations achieve this. Get in touch to find out more.

References

Neobanking 2023 (https://www.simon-kucher.com/en/insights/neobanking-2023)

Why fintech upstarts have failed to unseat UK banks (https://www.ft.com/content/803bfa1e-a0da-4dd0-9624-b5e62aa4fde5)

Launching Speed Boats from Cruise Ships (https://financialit.net/blog/incumbents/launching-speed-boats-cruise-ships-how-incumbents-can-take-fintech-challengers)

Digital bank Starling reports first profit on back of strong loan book (https://www.theguardian.com/business/2022/jul/21/digital-bank-starling-reports-first-profit-on-back-of-strong-loan-book)

Monzo – Annual Report 2024 (https://monzo.com/annual-report/2024)

Revolut revamps Premium and Metal plans with new partner subscriptions (https://www.revolut.com/news/revolut_revamps_premium_and_metal_plans_with_new_partner_subscriptions/)

Revolut & Chase: The retail media boom comes to banking (https://www.warc.com/content/feed/revolut--chase-the-retail-media-boom-comes-to-banking/9414)

More than 200,000 join waiting list for Monzo investment platform (https://www.ftadviser.com/investments/2023/09/20/more-than-200-000-join-waiting-list-for-monzo-investment-platform/)

Introducing Extra, Perks and Max (https://community.monzo.com/t/introducing-extra-perks-and-max/162646)

Nu Holdings Ltd. Reports Fourth Quarter and Full Year 2023 Financial Results (https://international.nubank.com.br/company/nu-holdings-ltd-reports-fourth-quarter-and-full-year-2023-financial-results/)

How we created Tabs: a new UI for a new financial experience (https://building.nubank.com.br/how-we-created-tabs/)

Smarter platform: how intelligent suggestions in the Nubank app empower customers (https://building.nubank.com.br/smarter-banking-how-intelligent-suggestions-in-the-nubank-app-empower-customers/)