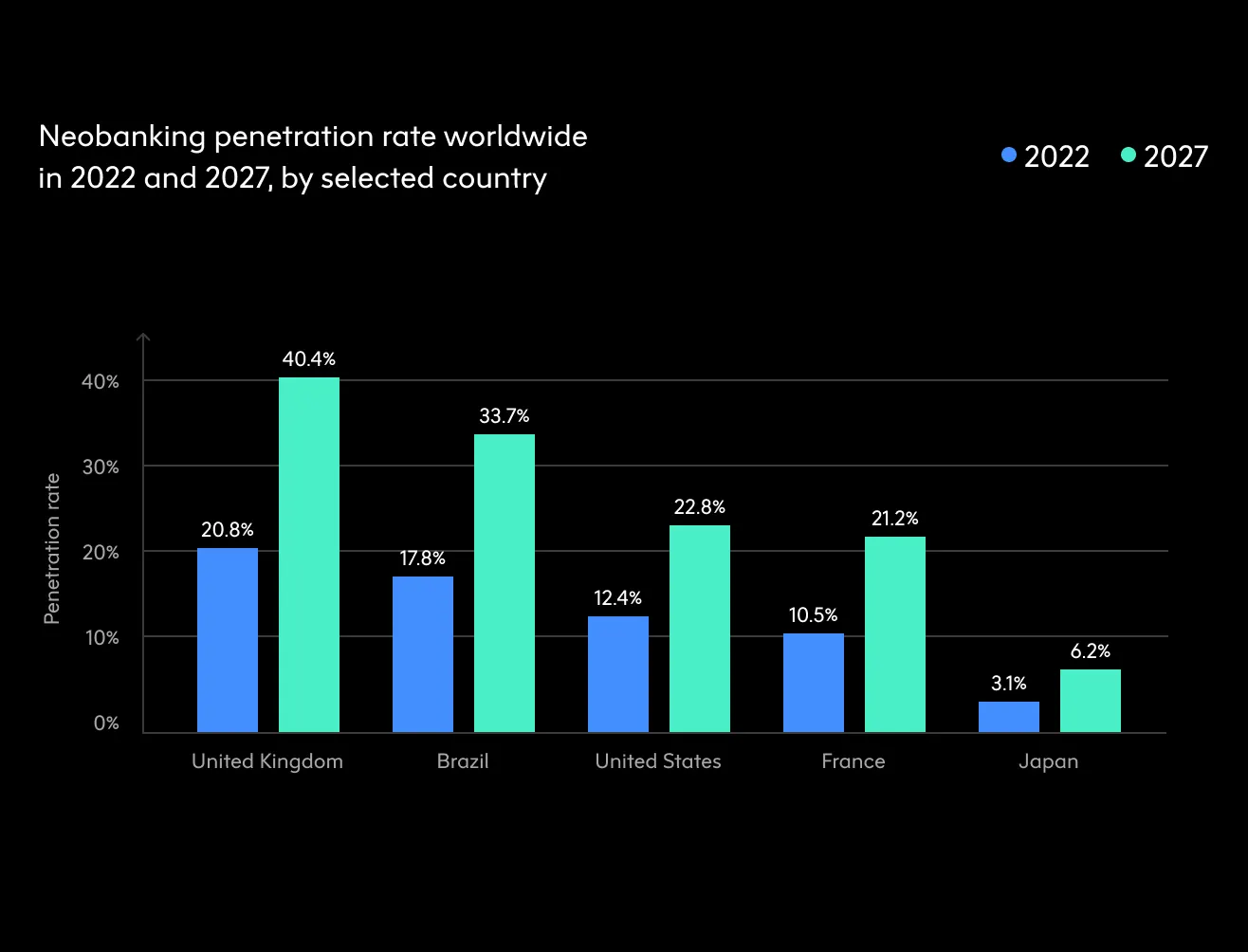

After a period of high interest rates, we have seen neobanks shift their strategy focus from ‘growth at all costs’ to profitability. But with increasingly concentrated markets in the UK, US, Brazil and France, the opportunities in neobanks’ home markets are getting smaller (see below). So, to achieve this goal, it is clear that neobanks around the world are targeting international expansion.

Worldwide penetration growth rates from 2022 to 2027. Source "Statista".

Nubank has become the first neobank to hit 100 million users, targeting underbanked populations in Brazil, Mexico and Colombia. Revolut, after expansions to US, Brazil and New Zealand, now boasts 40 million across 38 different markets, and is set to launch in Mexico and India in the coming year. And, after fresh fundraising, Monzo has announced $190 million in funding for its second attempt at the US market.

However, scaling banking experiences across continents introduces unique growing pains and challenges, especially for digital teams. In this blog, through NuBank and Revolut, we will explore the strategies employed by digital teams to successfully manage the shift towards a multi-market environment and draw some conclusions on how other banks might tackle this problem too.

The multi-market CX challenge

On paper, neobanks are well suited to international expansion. They have tried and tested go-to-market strategies, for example Revolut’s low-cost FX and international money transfers proposition. They boast industry-leading digital teams and capabilities, for example Nubank’s team are world-renowned for their user-centric approach. And, importantly, they do not have the overheads of redistributing physical resources and branches that face traditional banks.

On paper, neobanks are well suited to international expansion, however, very few have been able to successfully and sustainably grow across borders.

Very few neobanks have been able to successfully and sustainably grow across borders. Monzo was forced to end its US expansion attempt after it failed to push through its application for a banking licence. In the UK, N26 had to withdraw from the market after only 2 years, after legal action, poor customer engagement and monetisation issues, and Bunq, a Europe-wide neobank, soon followed them.

Significantly, digital teams face the challenge of international expansion head on, specifically through customer experience. So what makes delivering multi-market CX so difficult?

Localised Banking Patterns

Digital teams must adapt their CX to the distinct banking patterns of countries, regions and continents. To highlight just a few, 62% of payments in Vietnam are made using QR codes, default rates are significantly higher in Mexico than in Brazil and per-capita cheque usage in the US remains highest in the world.

Competition

The neobank market in the UK, US and EU has become highly concentrated, resulting in limited scope and high expectations for new entrants. What’s more, traditional banks, through app updates and launching their own speedboats, are closing the digital advantage and differentiator gained by neobanks.

Customer Support

Digital teams must consider how to deliver cost-efficient and localised customer support journeys. For example, in Brazil, consumers prefer customer service through Whatsapp whilst in the UK, the majority (69%) of consumers still want to be contacted over the phone.

Regulation

Beyond banking regulations, accessibility and advertising laws, such as the new EU Accessibility Act or UK’s Consumer Credit Regulations, create local differences in the way digital teams can build digital platforms and advertise. For example, Revolut has battled with UK regulators over advertising standards in the past.

In moving to a multi-market environment, neobanks’ digital teams must navigate a number of CX challenges. Fortunately, there are some great examples to draw inspiration from.

Neobanks' digital teams are working on CX challenges

NuBank

By 2019, Nubank had grown to a full-service banking offering in Brazil, including insurance, investments, savings and more. It was at this point, they launched a targeted expansion in South America, launching in Mexico and, then in 2020, to Colombia. Fast forward 5 years, their approach has reaped rewards, successfully establishing themselves in two new markets whilst growing to 100 million customers and reaching $1+ billion in profit.

The Mexican Bump In The Road

Nubank initially launched in Mexico with the same credit card proposition – aiming to replicate the model that worked so well in Brazil. However, it was not plain sailing, it was clear that the proposition was not performing as well in this new market. For example, Nu Mexico lagged behind industry growth levels whilst, in Brazil, the digital bank continued to take the country by storm.

The reality was that, in Brazil, the growth of their fee-free credit card proposition benefited from unprecedented organic growth, low delinquency rates and regulatory changes. In contrast, in Mexico, higher default rates amongst customers and cautious regulators stunted growth.

A global language with local tunes

Nubank recognised a more strategic approach to international expansion was required to reverse this trend and drive sustainable growth in these new markets. Over time, Nubank built a multi-market digital strategy built around the ethos of ‘speak a global language yet sing local tunes’. Since implementing this new approach, Nu Mexico has experienced greater growth rates than Nu Brazil did at the same point (see below) and has reached more than 1 million customers in Colombia.

Comparison between Mexican and Brazilian milestones

What does this look like in practice

To ‘speak a global language yet sing local tunes’ in a multi-market environment, Nubank first focused on its proposition. After recognising the poor uptake and performance of the credit card, Nu Mexico’s customer and market research identified their savings product, Cuenta Nu, as a suitable option for their second financial product. From a customer experience perspective, the savings account combined a superior digital experience and competitive rate, creating a more attractive proposition than traditional alternatives. And, unlike the credit card offering, customer barrier-to-entry was low; 1 million customers opened accounts within 1 month of launching the account. From a business perspective, the savings account also allowed access to local deposits, unlocking growth opportunities by expanding its customer base.

Secondly, Nubank focuses on delivering a localised customer experience, enlisting the help of two teams. The app experience team empowers digital product, design and engineering teams with the data, processes and deep understanding of the customer by “listening intently to the needs of markets”. And, the Design System team enables the app UI to flex to local needs whilst remaining consistent with design strategy and business imperatives such as efficiency and maintainability. It’s this “symbiotic relationship” that delivers a coherent and consistent, yet distinctive and locally resonant digital experience for Nubank users across Brazil, Mexico, and Colombia.

For example, in Brazil and Mexico, there were established patterns for viewing your Credit Card balance - called the CC Dashboard. However, when launching in Colombia, they discovered local nuances that existed; customers needed a clear, easy-to-understand snapshot of their financial status. Here, deep customer research and the flexible Design System created a bespoke CC dashboard that resonated most with Colombian customers. For example, they curated a PDF statement feature that “presents the necessary information in a digestible format” for Colombia.

In contrast to neobanks such as Revolut, Monzo or N26, that have taken on intercontinental growth, Nubanks multi-market expansion strategy has targeted specific markets in South America. And, their CX approach has matched this, prioritising customer-centricity by flexing product, design and engineering on a case-by-case basis to deliver a localised experience.

Nubank focusses on delivering a localised customer experience with two focussed teams

Revolut

Revolut’s founder, Nik Storonsky, launched the neobank with the aim of becoming “the first truly global bank”. As such, multi-market has always been central to Revolut’s strategy and operations, from its first prepaid travel debit card to their technology strategy and more recent changes to subscription tiers.

In 9 years, Revolut has grown to more than 38 markets serving more than 40 million customers worldwide – a speed and scale that has not been met by any other neobank. Whilst the majority of growth has been in Europe, Revolut has now shifted to more global expansion efforts including adding Brazil and New Zealand in 2023 and eyeing up India and Africa in the coming years.

So how did they get here?

Revolut’s market expansion strategy includes a lean MVP product and intelligent localisation solutions to allow fast launch cycles in new geographies (fast for design, product and regulation alike). This localisation framework is built on five pillars:

Strategic Vision

The first pillar of the framework aims to translate the overall vision of Revolut – “for everyone to do all things money — spending, saving, investing, borrowing, managing, and more — in just a few taps” – into a localisation roadmap. Here, the top-level group strategy informs a market strategy which informs the strategic objectives and, in turn, leads to a localisation roadmap; placing the Revolut vision at heart of what they do.

Local Leadership

In each market, Revolut hires local leaders who understand the local market and can build empathy with their customers. Here, leaders that understand the local nuances can help overcome certain challenges for great CX. For example, in NZ, they planned to run a university campaign using QR codes – however, the market lead suggested changing this based on local preferences.

Legislation & Regulation

A deep understanding of local legislation and regulation is a massive part of Revolut’s localisation strategy. Not only does this prevent unpleasant surprises from regulators, but this understanding can be built into strategies and frameworks, turning potential blockers into an enabler of growth and scaling. For example, whilst Revolut continues its 3-year long wait for its UK banking licence, it has in the meantime leant into its subscription tier, adding an ‘Ultra’ tier in 2023, to deliver better CX and support business objectives.

A “default MVP”

When it comes to (financial) products, Revolut strikes a balance between a standardised approach and flexing to the local needs of the market. On one hand, they have developed a set of products and features bundled together, known as a “default MVP”. This includes foreign exchange, peer to peer payments and split bills – products and features which display high usage frequency across markets. On the other hand, Revolut adapts its CX and product to the needs of customers in the new market. For example, Revolut utilises a global KYC (Know Your Customer) provider, where previously journeys are largely ‘copy and pasted’ across markets. However, in NZ, where some Kiwis have a traditional Maori face tattoo (Tā moko), they ran additional usability testing to ensure the app wouldn’t incorrectly decline these customers. Similarly, they also delayed the NZ launch to allow the team to add additional card security options, after fraud was identified as a high priority for Kiwis during research.

Scale & Grow

At launch, Revolut starts with a lean product, as outlined above, and team, between 2-3 people. To trigger further investment and evolution of the product, Revolut has a clear set of metrics, such as ROI and KPIs, that must be hit by its initial product, essentially, achieving ‘local market fit’.

Additionally, Revolut has also built a scalable and efficient product stack to enable cost-effective global expansion. For example, they utilise translation technologies across all markets and have efficient processes that automatically update ‘Master’ design changes at the local scale. These initiatives have helped drive down spending on expansion e.g. in 2023 “New Products & Global Expansion” only represented 8% of all spend.

What can we learn from this?

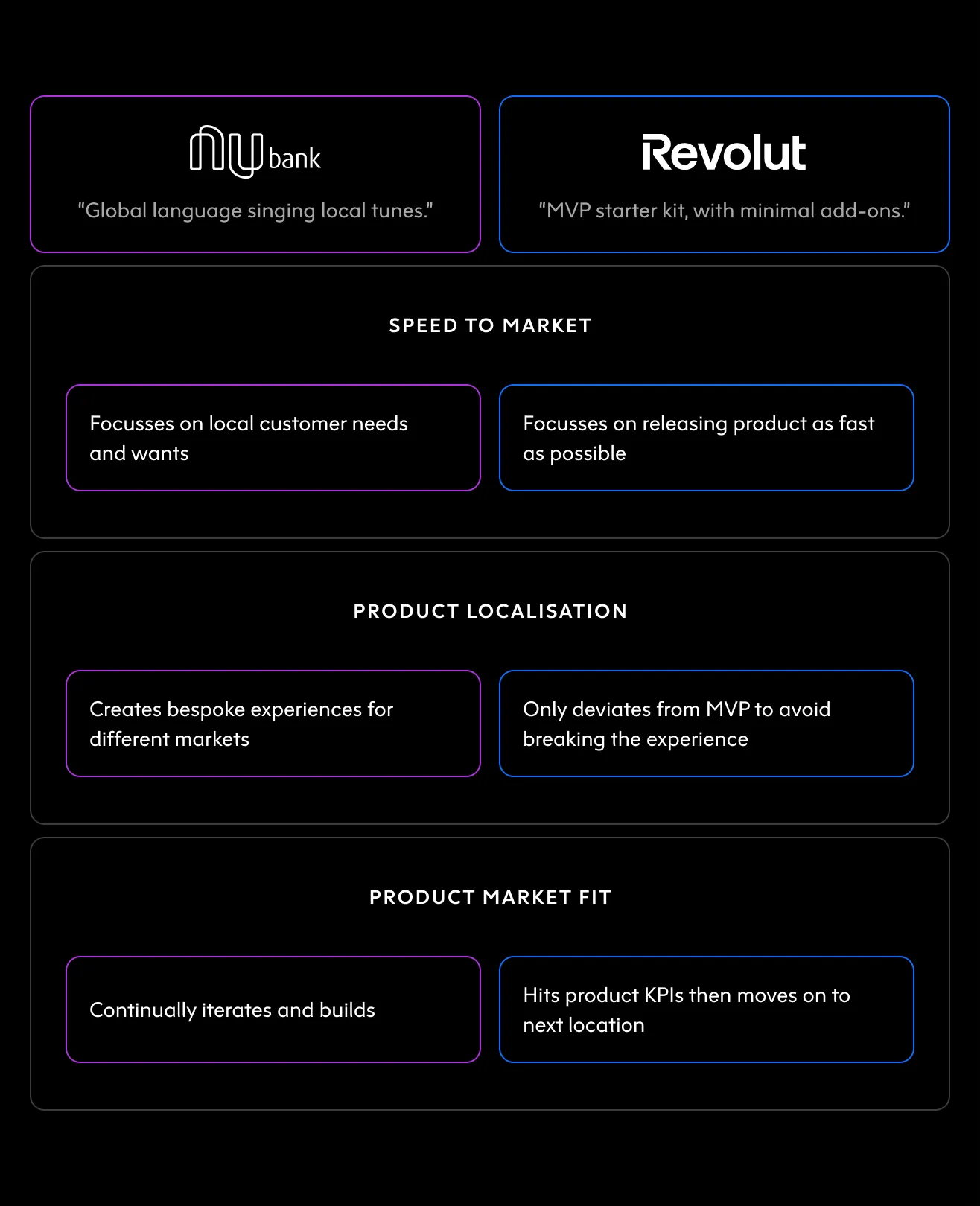

Product strategy comparison between Nubank and Revolut

In this blog, we have seen two different, yet successful approaches to overcome the multi-market CX challenge. Nubank, with its more targeted multi-market expansion, has leant into their customer-centric approach, flexing product, design and engineering on a case-by-case basis to deliver a localised CX. Revolut, in contrast, has built a more streamlined approach that prioritises speed to market, mitigating the risks around local regulations, preferences and competitors. Clearly, there is no single recipe for success; a CX strategy must be built on the unique internal and external opportunities facing organisations.

For executives and senior leaders navigating multi-market expansion, we recommend looking at your strategy through two lenses. On one hand, consider how you might flex the digital experience to meet local customers' needs. In practice, this might look like:

Introducing new customer service channels e.g. in one country, customers might be happy to be contacted through Whatsapp whilst in another, customers might want to be spoken to on the phone.

Redesigning UI and IA to cater to local nuances e.g. customers in a country where the norm is to have multiple accounts might want a view of all their accounts through open banking.

Building localised, customer-centric ways of working and capabilities e.g. hiring experienced product designers or researchers that have local knowledge and expertise.

On the other hand, the business lens; ensuring multi-market expansion is financially and reputationally sustainable. In practice, this might look like:

Redesigning or building new customer journeys that cater to local regulations e.g. onboarding journeys that include credit or eligibility checks.

Building a low-cost, efficient and flexible technology stack e.g. utilising a global technology provider.

Constructing clear data-driven frameworks for decision making e.g. KPIs or other metrics to determine future investment and expansion of digital channels.

Ultimately, digital teams must combine these into a coherent strategy; identifying how these business and customer lenses piece together within the context of their organisation. With this strategy, banks and financial institutions can create excellent digital experiences, elevating their digital products to new markets. At Elsewhen, with experience working with several Neo and established banks, we are uniquely positioned to help organisations achieve this. Get in touch to find out more.

References

Nubank surpasses 100 million customers (https://international.nubank.com.br/100m/nubank-surpasses-100-million-customers/)

Monzo secures $190m investment and hits $610m funding milestone (https://fintech.global/2024/05/09/monzo-secures-190m-investment-and-hits-610m-funding-milestone/#:~:text=UK%2Dbased%20digital%20bank%20Monzo,CapitalG%2C%20Alphabet's%20independent%20growth%20fund)

Monzo abandons U.S. banking licence bid (https://www.reuters.com/business/finance/monzo-abandons-us-banking-licence-bid-2021-10-04/)

Customer blunders and tensions at the top – behind N26’s failed UK expansion (https://sifted.eu/articles/n26-failed-uk-expansion)

Over 60% of Vietnamese use QR codes to pay (https://hanoitimes.vn/over-60-of-vietnamese-use-qr-codes-to-pay-326378.html)

Lower Credit Growth, Higher Default Rate Make Mexico a More Complex Market for Nubank (https://www.bloomberglinea.com/2023/04/29/lower-credit-growth-higher-default-rate-make-mexico-a-more-complex-market-for-nubank/)

US check use for payments exceeds other countries: Fed (https://www.paymentsdive.com/news/check-payments-federal-reserve-report-noncash-digital/691512/)

The Rise of WhatsApp in Brazil Is About More than Just Messaging (https://hbr.org/2016/04/the-rise-of-whatsapp-in-brazil-is-about-more-than-just-messaging)

Revolut: 'Single-shaming' ad firm accused of faking data (https://www.bbc.co.uk/news/business-47168860)

Nu Mexico announces the public launch of Cuenta Nu (https://international.nubank.com.br/consumers/nu-mexico-announces-the-public-launch-of-cuenta-nu/)

NuStories: Tailoring products for fanatical customers in various countries (https://building.nubank.com.br/tailoring-products-for-fanatical-customers-in-various-countries/)

Cuenta Nu reaches one million accounts one month after complete launch in Mexico (https://international.nubank.com.br/consumers/cuenta-nu-reaches-one-million-accounts-one-month-after-complete-launch-in-mexico/)

ProductTank Wellington: Launching Revolut in New Zealand: The Power of Product Localisation (https://www.youtube.com/watch?v=fJuDo_vfQ0E)

Revolut - a UK-based fintech success story (https://www.theglobalcity.uk/resources/revolut)

Revolut Annual Report 2023 (https://www.revolut.com/blog/post/annual-report-blog-2022-2023/)