As I explored in the previous article (here), the customer experience revolution in digital financial services is well underway. In this blog I’ll introduce a few of my favourite experiences that are paving the way for simple, yet rewarding ways in which customers can do more with their money, whether it be managing, saving, or investing.

I’ve selected these four examples based on what I find myself using often, but also because they have the potential to buck many of the trends we are seeing such as micro-savings, personalisation, and increased disruption in the investment and digital asset space.

1. N26 Spaces

N26 Spaces is a new feature that allows customers to create sub-accounts (without an IBAN) in the app. They are positioned as a tool to help obtain goals or support financial organisation. I find myself using goals extensively for the latter.

What is it?

Spaces allows customer to create sub-accounts via a dedicated tab in the app. This sub-account can be used to track goals, with each space allowing you to set a total and see your progress. You can also add an image to each goal and although these aren’t customized by the user, they are pretty fun. You can easily transfer money from your main account to various spaces by dragging the spaces which makes for a nice user experience. What’s great is that when you move money from your main account, to a space, the balance of your main account decreases, to reflect the amount you actually have to spend taking into account your goals.

What it solves for customers

The goals feature in Spaces isn’t anything particularly new here and most other mobile banks offer a similar feature (Monzo, Starling). For me, the real gem is how easy it is to achieve financial organisation. It’s not just the user experience and speed in which you can set up spaces, but it’s the way the main account balance deducts and reflects on your home page in the app. This essentially tricks you into believing the main account balance, is your “safe to spend”. For me, I can truly get a sense of how much I can spend when I am able to cleverly withdraw my rent, bills, savings, Klarna and American Express bills and so on.

What could the next version add?

Version two could look to have associated IBANs which would allow users to make or receive payments, which is similar to Bunq, or more automatic savings for each space. For example, a feature with a roundup of transactions giving you the ability to set which Spaces these go—e.g. round up every transaction and put it into my “World Trip” space—would be an excellent way for customers to avail of micro-savings.

Freetrade app

The “TransferWise of Investing”, as I like to think of it, Freetrade allows customers to easily invest for free in companies and ETFs. Pretty much everything in this app is worth highlighting.

What it solves for customers

It essentially removes the cost barrier of investing in stocks and a selection of ETFs, which is traditionally offered by incumbent banks at a cost of well over £10 per trade. The low cost combined with the incredibly user friendly UX, allows anyone to start trading (as long as they have an iPhone), opening up a historically closed market.

It easily allows customers to manage their portfolio, track their investments, and most importantly, invest. The user experience for investing is sleek, and I particularly like the transparency around any fees charged, and the design of the app itself. The overall feel of the app removes the traditional day trader-esque intimidating UI from incumbent banks or specialists

What could the next version add?

Freetrade is in its early days, with beta for Android being rolled out this month. Access to additional markets is on the Freetrade roadmap, but I would like to see greater integrations with existing fintechs or challenger banks.

For example, partnering with Monzo in a way similar to TransferWise and N26, which would allow Monzo customers to begin investing. Furthermore, linking up with a Chip or Oval Money where micro-savings made can be diverted to the Freetrade app. In an increasingly open and collaborative space, partnering would be a great way to Freetrade to increase its customer base.

Emma Wealth and crypto account aggregation

What is it?

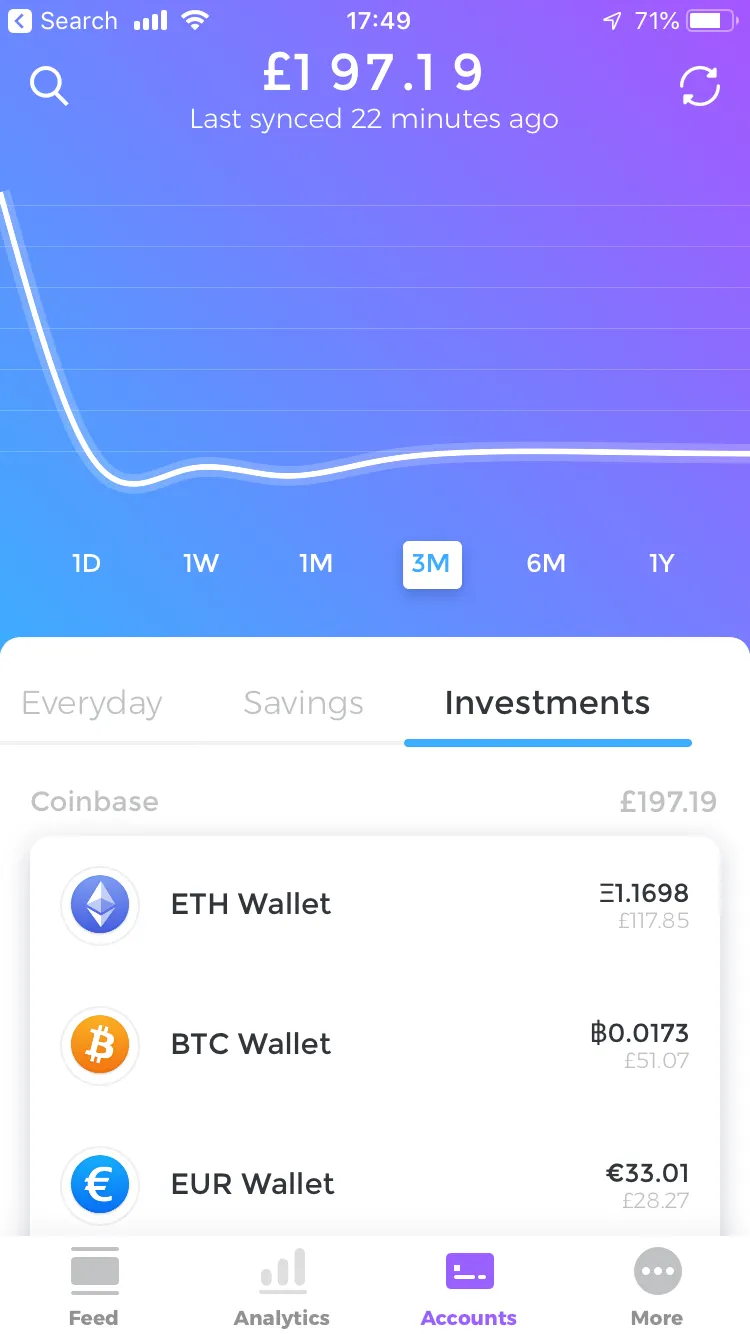

Emma provides money management insights based on account aggregation. It is similar to Yolt and Bud, helping customers avoid overdrafts and cancel wasteful subscriptions, but what I like about Emma in particular is the planned breadth of account aggregation, specifically in the fintech and crypto spaces. It is making real strides towards proving a truly holistic view of one’s finances.

What it solves for customers

Emma is looking to become the Mint (USA) for the UK, allowing full-scale aggregation, something which has been lacking from other providers. I really like the fact that you can aggregate the main crypto wallets like Coinbase, and PensionBee. Other important fintechs like Freetrade, Chip and Nutmeg are not available, but I have no doubt that once the necessary APIs are created, they will be available.

As mentioned, Emma is making strides towards creating a truly one-stop-shop for account aggregation for those customers who are increasingly using fintech and diversifying their investments. It's worth noting however, that the crypto integration isn’t likely to appeal to all digital asset holders, but likely will appeal to light traders.

What would V2 look like?

Lock down aggregation of those providers which aren’t yet available such as Freetrade, Nutmeg etc.

Monzo (and ING and Qapital) and IFTTT

What is it?

IFTTT is an app similar to Zapier that allows users to get their apps and devices talking to each other. Banks and fintechs are increasingly using IFTTT, allowing their customers to personalise the way they save. With the case of Monzo, it offers pre-build applets that they can sync with their Monzo account to initiate transfers into their savings pots.

What it solves for customers

It’s a simple way for a bank to allow personalised micro-savings without necessarily needing to integrate a white label provider (such as Chip or Oval Money) or build a solution from scratch. In the case of Monzo, it’s simply enhancing the existing savings pots.

Users can save in a way that works for them, such as rounding up purchases, or saving a fixed amount for certain types of transactions or actions. Monzo suggests some pretty cool integrations such as:

Set up an applet that automatically puts a pound into a digital swear jar every time you press an internet-connected button at your desk

Rewards you with £5 every time you visit the gym

Adds a track to a Spotify playlist when you spend money at a certain shop

What could a V2 look like?

I would like to see Monzo open this up by allowing customers to make external transfers. At the moment Monzo does not offer any dedicated savings or investment accounts so there is no financial incentive for holding any potential savings with Monzo. By allowing customers to send the money to other accounts, Monzo will really delight customers.

Conclusion:

Making journeys both relevant and easy is absolutely key in the race to delight customers. Customer delight comes from ease of savings, increased personalisation and catering to those who hold digital assets.

In that regard Freetrade is the most comprehensive example here, with both a beautiful customer experience and a disruptive pricing model. However, simple features and partnerships could be implemented to win over a greater proportion of your customers, such as IFTTT integrations and better money management via N26 spaces.

Keeping up with shifting customer expectations, launching smart features and competing on price is now more important than ever, given the news of the Apple Credit Card, which competes on price, ease of use and mostly likely a range of delightful features. Will this list look the same in a year, or even six months from now? We’ll have to wait and see.

Image attribution: Marco Verch — Flickr