Unlocking new avenues in car insurance

Summary

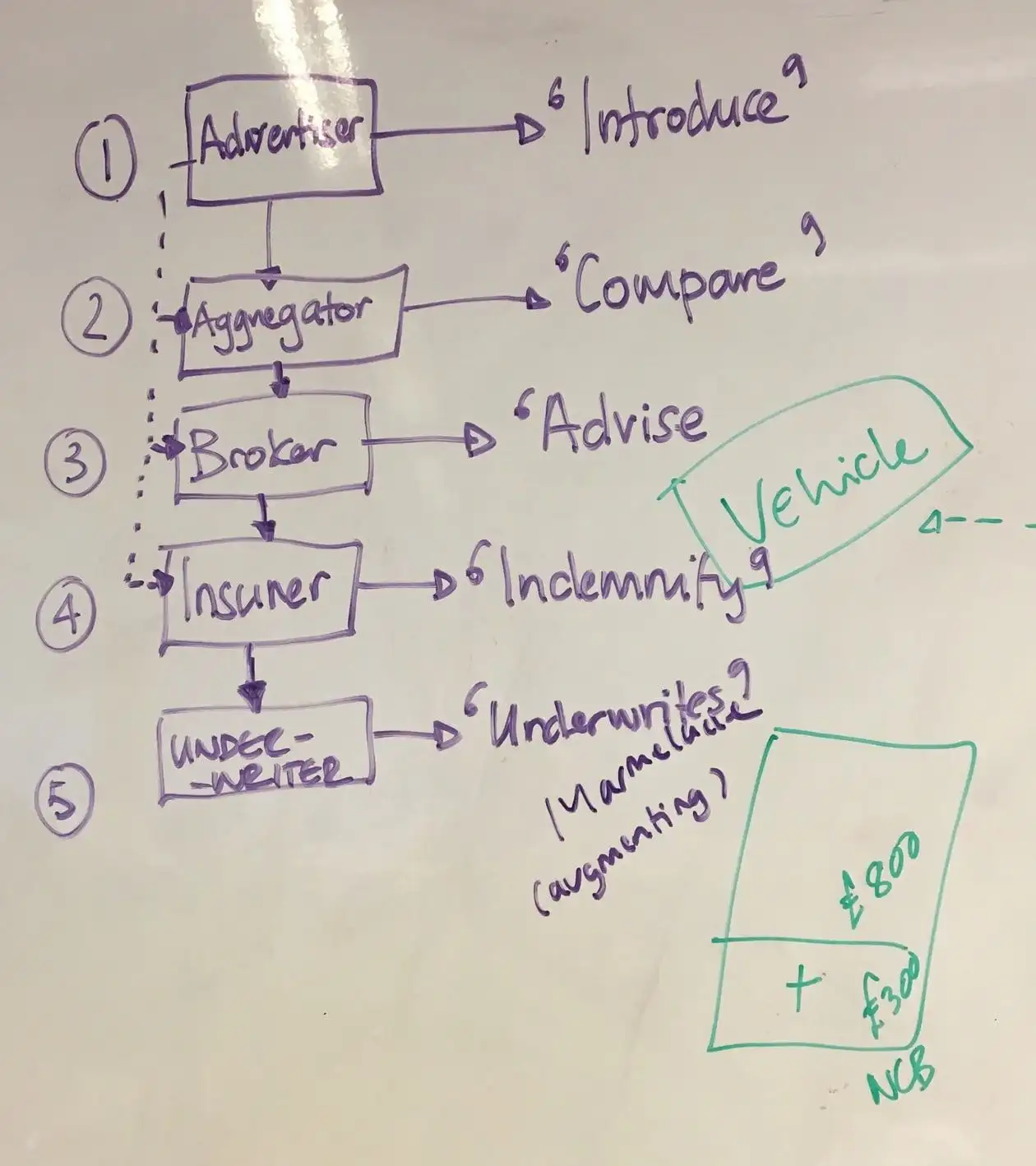

It's estimated almost half of all online insurance is sold via comparison sites like GoCompare. While the leading aggregators invest heavily in marketing, they also build and run their own technology, devising new solutions to gain an advantage over competitors, and better serve customers.

When GoCompare approached Elsewhen, car insurance remained opaque and inflexible despite the many exciting developments in insurtech. GoCompare tasked Elsewhen with looking for opportunities to disrupt the existing car insurance policy stack and the ecosystem of aggregators and insurance providers.

Our services

- Market sizing and definition

- Opportunity definition

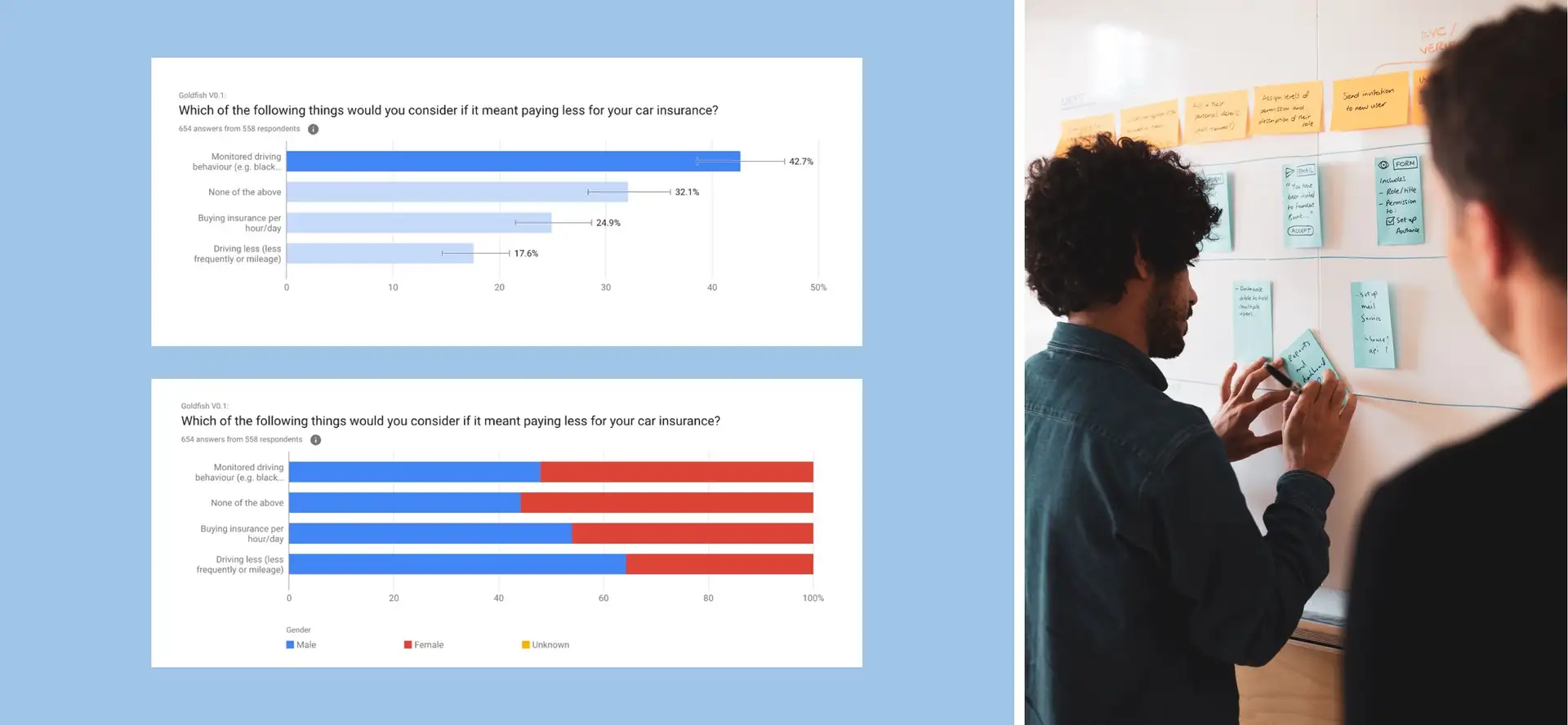

- Data analysis

- Ethnographic research

- Value proposition & testing

- Commercial acumen

- Rapid prototyping

- Technical approach

- The context

- The emerging importance of data in insurtech

Insurance is going through its own process of disruption, and the inevitable shift towards new solutions, new business models, and ultimately new market leaders has begun in earnest. In this market, incumbent insurance providers risk being left behind—outmaneuvered by emerging players, including aggregators, with new thinking and new models.

As in parallel industries, forward-looking incumbents are working to transform themselves, and make the necessary shift in their thinking. Many are working with partners to find ways to use technology to unlock new customer segments, and new methods to tackle margin compression.

As part of their offering, the leading aggregators also build and run their own technology, allowing them to absorb a huge amount of data, which could provide clues to owning more of the insurance value chain. Elsewhen were brought on as a strategic partner to dive into this well of data and identify potential opportunities for GoCompare.

- The challenge

- Weighing up risk and opportunity in niche segments

Aggregators like GoCompare are often the CX layer customers interact with, at both the start and end of their buying journey—looking to the comparison site for the best price and ultimately returning to make the purchase directly with the aggregator.

There is also an increasing advisory layer to the aggregator offering, where rather than just deliver hard-won leads to insurers, they operate like a broker making recommendations—one of many potential avenues that brings higher risks, and higher technological barriers, but potentially higher margins as well.

As in parallel examples of technological disruption, insurtechs and other players in the insurance space have found success by tackling niche market segments the incumbents have traditionally avoided—perhaps where the propensity for risk is higher, or the potential for margins are slimmer, for example for younger claimants.

Alongside the increased risks unique to a segment like this, there comes opportunities: younger demographics put a premium on better customer experience, are often potentially overcharged for car insurance, will often opt for digital solutions over traditional methods, and generally lack the brand loyalty that incumbents enjoy from older demographics. With that in mind, we were tasked by GoCompare to explore if and how they could unlock customer segments like this one.

- Our strategic approach

- Market & opportunity analysis to produce hypotheses

We broke down the work into two distinct phases, both led by data, with testing throughout, so that no shaky assumptions remained left unchallenged.

The first phase of work was a detailed market and opportunity analysis—where Elsewhen’s team calibrated with GoCompare—to absorb GoCompare’s considerable knowledge. This included a breakdown of the market, the journeys their customers typically take, their commercial models, and so on.

We absorbed this information both by directly going through the data, and by conducting a variety of workshops. This would give us the first hypotheses on where to dig for oil—locating potentially untapped opportunities for GoCompare.

This experience fed into the next stage of the process, allowing us to begin planning and refining the product/project strategy. From here we produced tests—to help prove or disprove the new assumptions and hypotheses that emerged from the data download. This is done through a combination of customer, technology, business, and market tests which were decided and prioritised together with GoCompare.

- The solution

- Using data to find new business where others can’t

As a result of the various rounds of tests, particularly those conducted with real customers, it became clear that there were exciting opportunities to serve these customers in a scalable and profitable way if the right solution was found.

We were able to make strategic recommendations to GoCompare in the form of multiple proofs of concept, backed by real data, that both solved existing problems and illuminated new business opportunities for GoCompare to build on and take to market.

Transform how your most important work is delivered

Meet the team, discuss your ideas with our experts and receive a proposal for your project.